Analyst: Android US smartphone share drop to continue

In a note sent to investors on Monday, Needham & Co. analyst Charlie Wolf predicted Android would regain share in the June and September quarters before a "material decline" in the December quarter following the expected launch of the iPhone 5. "In our opinion, this is just the beginning of Android’s share loss in the U.S.," Wolf wrote.

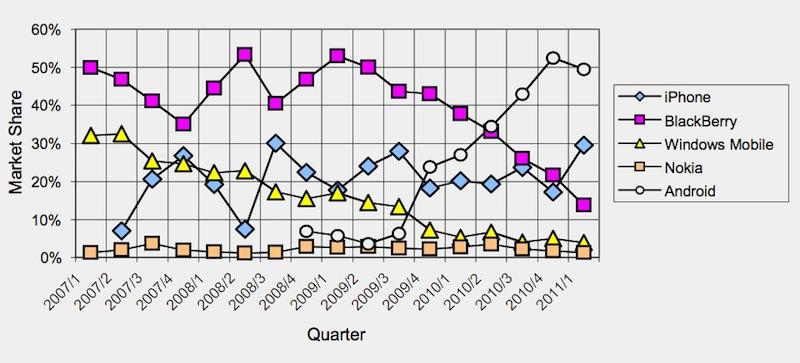

Android's share of the U.S. smartphone market fell from 52.4 percent in the December quarter to 49.5 percent last quarter. The drop was the first sequential loss of market share in any region for Android since it began its "growth rampage" in 2009.

Wolf attributed the dip to the launch of the iPhone 4 on the Verizon Wireless network, while also acknowledging that a "substantial percentage" of Verizon subscribers appear to be waiting for the next iPhone before upgrading. Verizon has indicated that it will receive the next iPhone at the same time as AT&T. Wolf also speculates that "the iPhone could launch on the Sprint and T-Mobile networks this fall," which could give Apple another boost in share.

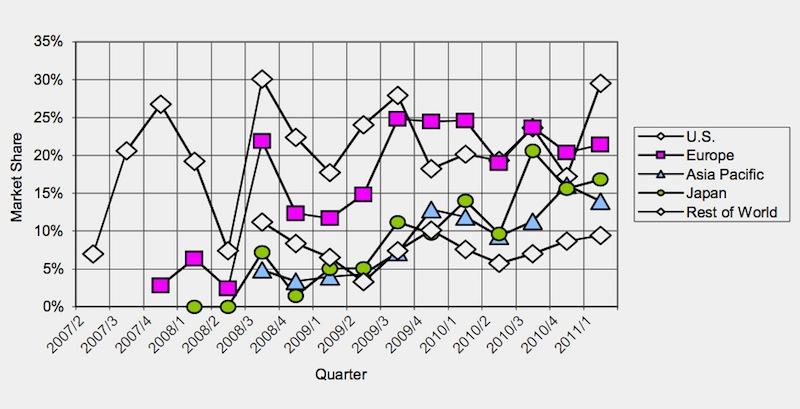

U.S. smartphone market shares | Source: IDC

The fact that the iPhone's share of the U.S. smartphone market jumped up 9 percent in the March quarter, while the device's share in other regions held steady, suggests to Wolf that the Verizon iPhone drove iPhone growth in the U.S. last quarter.

Worldwide, Wolf views Android as "well positioned" to make gains in the two markets with the largest installed bases of feature phone users — Asia Pacific and the Rest of World regions. Apple, on the other hand, is faced with the challenge of building an "iPhone Lite" for prepaid markets like China, said Wolf.

Apple has, by its own admission, "been on a tear" with the iPhone in China. iPhone sales were up almost 250 percent in Greater China last quarter. However, the iPhone maker has yet to scratch the surface of the Chinese market, which has an estimated 896 million mobile phones in use as of May.

Wolf takes recent comments from Apple COO Tim Cook regarding the company's extensive market research in China to mean that Apple "appears to be considering" a cheaper iPhone for emerging markets. In February, Cook reportedly said the company is planning "clever things" for the prepaid handset market and doesn't want its products to be "just for the rich."

Rumors swirled this spring that Apple plans to release a cheaper iPhone for prepaid customers. Reports also suggested Apple could make the device smaller and significantly lighter.

A March survey found that 53 percent of respondents planning to buy a 3G smartphone would purchase an iPhone if the price was lower, compared to 30 percent who would purchase the smartphone at its current price.

In his report, Wolf highlighted continued struggles from Research in Motion and Nokia. Calling it "a tale of two continents," Wolf pointed out that the BlackBerry's share of the U.S. market has "imploded" from 37.8 percent a year ago to 13.8 percent in March, while Nokia's share of the European market fell from 40.6 percent to 20.2 percent.

The broader smartphone market, however, continued "torrid growth," with shipments increasing by 84.7 percent. Smartphones' share of the mobile phone market accelerated to 28.1 percent in March, compared to 25.3 percent in December and 17.8 percent a year ago.

Josh Ong

Josh Ong

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Chip Loder

Chip Loder

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Michael Stroup

Michael Stroup

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele