GameStop planning iOS-like digital distribution, iPad-like game tablet

GameStop currently sells new and used video games from 6,500 retail outlets around the globe, with nearly half of its revenues coming from the resale of used video games. But the future of video games appears to mirror that of movies, books and music, all of which have seen physical media recede in importance as digital downloads rapidly erode former empires.

In an interview with Gamasutra, GameStop president Tony Bartel stated, "our customers are beginning to consume games in a hybrid manner, both physical and digital, so we are becoming a hybrid company to meet their needs."

However, Bartel also acknowledged, "we really don't anticipate we're going to have a model [for digital] where people can trade a game back in," meaning that the inevitable shift to digital distribution would demand significant changes in the firm's business model.

Going digital, developing tablet hardware

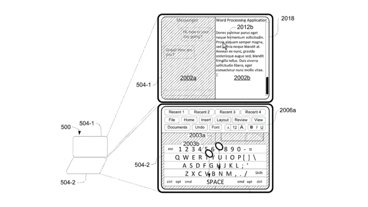

To make headway in digital distribution, GameStop has acquired Stardock's Impulse digital distribution service and streaming technology firm Spawn Labs, which is still testing its service privately. GameStop is also experimenting with tablet trade-in programs at a small number of its retail stores, and is examining the prospects of building its own gaming tablet.

"If we can work with our partners and the OEMs and they come up with a great tablet that is enabled with a great gaming experience and coupled with a bluetooth controller," Bartel said, "then there's no need to go out and develop our own. But if we can't find one that's great for gaming, then we will create our own."

GameStop's digital future sounds like Apple's iPad launch last year, when the company introduced the world's first popular tablet system. A very large proportion of the iPad's 65,000 unique titles are games, part of a digital distribution gaming model Apple began developing in 2006 with the release of iPod games within the iTunes Store.

Apple added the iPhone App Store in 2008, followed by the release of the iPod touch, which the company has nearly dedicated to handheld gaming. The launch of iPad has created even greater waves in the gaming industry, something many of Apple's competitors appear to prefer not to talk about directly.

One top game developer noted that its iPad launch last fall exceeded unit sales and revenues for not just game console digital stores such as Nintendo's WiiWare, Sony's PlayStation Network, and Microsoft's Xbox Live Arcade, but also trounced its PC launch via Valve's Steam gaming network.

iOS, of which the gaming industry speaks not

Gamasutra described Steam as being "the digital industry's 500 lb. gorilla," and Bartel agreed that "you can't walk into the digital space without tripping over Steam," but both parties of the interview deftly avoided direct mention of Apple's iOS platform or the iPad, making only passing comment of the what has become the gaming industry's euphemism for iOS: "the 99 cent model that Nintendo has so famously derided."

Nintendo executives have taken a dismissive attitude toward the iPad since its launch. Last year, Nintendo president Satoru Iwata told the Associated Press that Apple's then-new iPad was simply "a bigger iPod touch," saying he was "totally unimpressed."

Iwata's firm had just released the Nintendo DSi XL, a new version of its DS distinguished by… being bigger (albeit using the same screen resolution as previous models), a feature Iwata said resulted in a "portable system that can be enjoyed with people surrounding the gamer."

More recently, Iwata stated in his keynote address at last month's Game Developers Conference that "the objectives of smartphones and social-network platforms are not at all like ours. Their goal is just to gather as much software as possible, because quantity is what makes the money flow. Quantity is how they profit. The value of video-game software does not matter to them."

Iwata later commented, "when I look at retailers, and I see the $1 and free software, I have to determine that the owner doesn't care about the high value of software at all. I fear our business is dividing in a way that threatens the continued employment of those of us who make games."

Nintendo's DSi Shop, the equivalent of the iOS App Store for its mobile gaming devices, lists a catalog of 343 digital download titles that range from $2 to $8. Disney Interactive's "Jelly Car" is $5, while PopCap Game's "Plants vs Zombies" is $8. iOS versions of the same games are 99 cents and $3, respectively, for the iPhone version, or $3 and $7 respectively for iPad-optimized "HD" versions.

Nintendo lists another 1,175 physical games for the DSi available via retail, which are usually priced between $15 and $40, which represent the cartridges that GameStop resells used to generate the largest segment of its revenues.

Daniel Eran Dilger

Daniel Eran Dilger

Charles Martin

Charles Martin

Andrew Orr

Andrew Orr

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

William Gallagher

William Gallagher

Christine McKee

Christine McKee

22 Comments

HEAD->DESK

Why in the world does anyone think people will buy a Gamestop tablet for games, when they can get a $499 iPad which does a whole lot more, and has a much larger game library?

If its Android, then why does anyone think game devs will develop for Gamestop's Android tablet as opposed to all the millions of other android tablets on the market?

AhahahhHAAHAHAHAHAhahha ha ha ha ha ahahaha HAAHAHAHAHAH!!!!!!!

Yeah...... Good luck with that Gamestop.... idiots...

Isn't this more Amazon/Kindle-like than Apple/iPad-like?

HEAD->DESK

Why in the world does anyone think people will buy a Gamestop tablet for games, when they can get a $499 iPad which does a whole lot more, and has a much larger game library?

If its Android, then why does anyone think game devs will develop for Gamestop's Android tablet as opposed to all the millions of other android tablets on the market?

The only reason I can think of is that Gamestop has physical stores, where a game dev might see their game advertised to a focused audience.

The only reason I can think of is that Gamestop has physical stores, where a game dev might see their game advertised to a focused audience.

Damn, if only Apple had PHYSICAL STORES frequented by a FOCUSED AUDIENCE.