Apple gearing up to pay out $2.5 billion in dividends on Thursday

Apple announced its plans for a new dividend program in March, alongside a $10 billion share buyback program. Each quarter, the company stated it will pay its shareholders a $2.65 per share dividend.

Shareholders of record as of Monday August 13 will be paid dividends on Thursday, the company has announced.

Apple's chief executive Tim Cook noted that the company has "used some of our cash to make great investments in our business through increased research and development, acquisitions, new retail store openings, strategic prepayments and capital expenditures in our supply chain, and building out our infrastructure. You’ll see more of all of these in the future.

“Even with these investments," he added, "we can maintain a war chest for strategic opportunities and have plenty of cash to run our business. So we are going to initiate a dividend and share repurchase program."

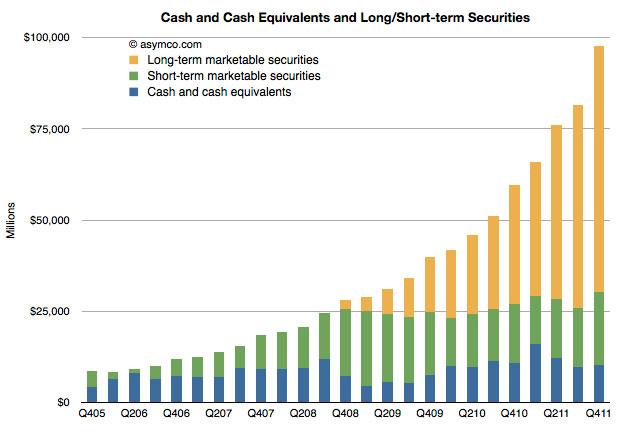

Can't spend fast enough to make a dent

Over the next three years, Apple has stated that its buyback and dividend plans will distribute $45 billion from its cash pile. Across the company's 935 million outstanding shares, the quarterly dividend will amount to nearly $2.5 billion in payments to investors each quarter.

In the most recent June quarter, however, Apple announced the accumulation of an additional $7 billion in cash, so the payment of $2.5 billion in dividends will not reduce Apple's cash hoard, nor even stop it from growing past its current height at $117 billion.

The growth trajectory of Apple's cash hoard, via Asymco.

Apple has likely earned nearly twice as much new cash in the first seven weeks of its new quarter than it will be paying out as a dividend for the previous one. Apple will pay out a second dividend in November, and continue paying new quarterly dividends about a month and a half after the end of each subsequent quarter.

A dividend equivalent will also be paid to holders of Apple's restricted shares, although Cook has declined to collect dividend payments for the 1.125 million shares of restricted stock he has been granted, which would otherwise be worth over $75 million.

The company's current dividend payment rate is quite modest when compared to its current and future cash position. At the same time, Apple's $2.5 billion in quarterly dividend payments makes it one of the highest dividend payers in the U.S.

Shareholders pay income taxes on dividends, but not much

Shareholders only pay a federal capital gains income tax on any stock appreciation when they sell their securities, but Apple's new quarterly dividend incurs income tax as it is paid out. This year, however, that tax rate remains extremely low.

Following the Bush Tax Cuts, tax payers in the lowest 10 and 15 percent brackets (individuals earning less than $35,000 in taxable income) pay nothing in long term capital gains tax, while higher earners pay just 15 percent on the profits any shares they sell in 2012 (if they've held the stock for at least one year).

Tax rates are the same for qualified dividend payments; lower brackets pay nothing while those in higher tax brackets pay a flat 15 percent tax rate on any dividend income. This means an individual earning more than $35,000 pays considerably more in taxes for earned income from labor or most other sources (at least 25 percent, currently up to 35 percent) than an investor pays on cash distributions they receive as dividends or share appreciation capital gains (15 percent).

This disparity between the very low federal tax rates on dividends or stock appreciation income and the much higher taxes that workers pay has resulted in criticism from even the very wealthy.

Billionaire investor Warren Buffett famously noted that he pays a lower tax rate on his investment income than his secretary pays in income taxes. The White House has jumped on this "Buffett Rule" to recommend that high income individuals should return to paying standard tax rates from the 1990s on their investment income and dividends.

The historically low federal tax rates for investment income are set to automatically expire at the end of this year, but Congress is virtually guaranteed to extend the cuts, and is currently only arguing over whom, if anyone, should be excluded from the huge tax breaks, based on their income.

U.S. President Obama has floated plans to extend the Bush Tax Cuts only for individuals earning income of $200,000 or less. That would allow the capital gains tax for higher income individuals to rise back to 20 percent, while dividend payments would be taxed at the same bracket as other income, up to a new 39.6 percent bracket for those earning more than $390,000.

The Democratically controlled Senate passed Obama's tax cuts for individuals making less than $200,000, while the Republican controlled House has passed a full extension of the status quo; the two will have to negotiate a plan to avoid the tax cuts from expiring automatically at the end of the year. The cuts were last extended two years ago at the end of 2010.

Daniel Eran Dilger

Daniel Eran Dilger

Malcolm Owen

Malcolm Owen

Charles Martin

Charles Martin

Mike Wuerthele

Mike Wuerthele

Chip Loder

Chip Loder

William Gallagher

William Gallagher

98 Comments

Can somebody buy AAPL on monday, collect the dividend on Thursday and then sell the stock on Friday?

I've never held a dividend stock before. $2.65 per share doesn't seem like a whole lot though, to be honest. Somebody can make that per share in a few minutes, just trading AAPL on any given green day.

Thank you Scamsung !

Can somebody buy AAPL on monday, collect the dividend on Thursday and then sell the stock on Friday?

I've never held a dividend stock before.

yes, but why would you sell? You get less than 3 dollars or less than .5%

Why not just have Samsung cut the checks?

Can somebody buy AAPL on monday, collect the dividend on Thursday and then sell the stock on Friday?

I've never held a dividend stock before. $2.65 per share doesn't seem like a whole lot though, to be honest. Somebody can make that per share in a few minutes, just trading AAPL on any given green day.

Yes. Minus two commissions to your broker and income taxes. Assuming it will be worth more when you sell it than when you bought it. Do the math to see if it is worth it.

Edit: BTW Welcome back from your vacation.