IDC projects Windows Phone to surpass Apple's iPhone by 2016

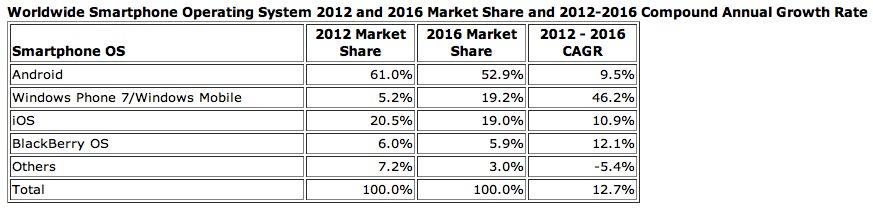

Results from the firm's Worldwide Quarterly Mobile Phone Tracker released on Wednesday point to a marked five-year compound annual growth rate (CAGR) of 46.2 percent between 2012 and 2016 for the Windows Phone platform citing Microsoft hardware partner Nokia's growing strength in emerging markets.

Although it currently only owns a 5.2 percent market share, less than RIM's BlackBerry, Windows Phone is slated to disrupt the mobile space to become one of the three main smartphone platforms beside Android and iOS. Microsoft's platform is forecast to have a 19.2 percent share of the market by the end of 2016.

"The mobile phone user transition from feature phones to smartphones will continue in a gradual but unabated fashion," said Kevin Restivo, senior research analyst with IDC's Worldwide Quarterly Mobile Phone Tracker. "Smartphone growth, however, will increasingly be driven by a triumvirate of smartphone operating systems, namely Android, iOS and Windows Phone 7."

While Android is expected to continue its domination through 2016 with 52.9 percent of the market, the OS will grow only 9.5 percent as the worldwide wireless market expands further into developing areas like China and India. Google's mobile platform, which will become increasingly dependent on Samsung device sales, is forecast to peak in 2012 as shipments begin to cool.

Source: IDC

The South Korean electronics maker is already the world's largest mobile phone maker and recently overtook Apple in smartphone shipments giving it a dominating presence in the wireless market. As it stands Samsung relies on Android to power its handsets but it may be looking into creating a new operating system as it was announced on Tuesday that the company paid a $500,000 fee to become a Linux Foundation board member. Although only speculation, the company could potentially use its significant coffers to further develop and refine the Tizen mobile OS in a slow move away from an increasingly fragmented Android.

IDC notes that Apple's installed customer base allows little room for growth and estimates that demand for the iPhone will slow in the next five years with sales mainly driven by replacement cycles. The momentum seen by the iPhone 4S in 2012 will result in overall shipment growth but a small decline in market share is expected. By the end of 2016 Apple is seen as having a 19 percent share of the overall smartphone market.

"Underpinning the smartphone market is the constantly shifting OS landscape," said IDC Mobile Phone Technology and Trends Senior Research Analyst Ramon Llamas. "Android will maintain leadership throughout our forecast, while others will gain more mobile operator partnerships (Apple) or currently find themselves in the midst of a major transition (BlackBerry and Windows Phone/Windows Mobile). What remains to be seen is how these different operating systems – as well as others – will define and shape the user experience beyond what we see today in order to attract new customers and encourage replacements."

Beyond the top three platforms, RIM's BlackBerry will surprisingly see relevance as the emerging market exhibits demand for cheap messaging devices. The Waterloo, Ontario-based company will have a CAGR higher than iOS and is projected to maintain a nearly 6 percent share of the market. It is no certainty that RIM can stay alive long enough to benefit from developing nations, however, as corporate turmoil and suffering sales have brought the once mighty telecom to the edge of irrelevance.

Mikey Campbell

Mikey Campbell

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Chip Loder

Chip Loder

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Michael Stroup

Michael Stroup

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele