Apple accused of sidestepping taxes, company counters by touting job creation

Apple issued the statement to The New York Times, which published it in full this weekend. It came in response to a report that claimed Apple sidesteps billions of dollars in taxes.

The report revealed that Apple has an office in Reno, Nev., just 200 miles away from its Cupertino, Calif., headquarters, to collect and invest its profits. By doing this, the company avoids paying California's 8.84 percent state income tax on gains.

"Setting up an office in Reno is just one of many legal methods Apple uses to reduce its worldwide tax bill by billions of dollars each year," the report by Charles Duhigg and David Kocieniewski said. "As it has in Nevada, Apple has created subsidiaries in low-taxes places like Ireland, the Netherlands, Luxembourg, and the British Virgin Islands — some little more than a letterbox or an anonymous office — that help cut the taxes it pays around the world."

The report from the Times comes on the heels of a separate story published earlier this month by the Daily Mail, which highlighted Apple's use of a headquarters in Cork, Ireland, which allows it to pay about half the tax rate than it would in the U.K. That report also noted that Apple has an offshoot based out of the Caribbean, where tax rates are favorable in the British Virgin Islands.

For its part, Apple said it has created an "incredible number of jobs" in the U.S. over the last several years. It noted that the vast majority of the company's global workforce remains in the U.S., where it has more than 47,000 employees.

"By focusing on innovation, we've created entirely new products and industries, and more than 500,000 jobs for U.S. workers — from the people who create components for our products to the people who deliver them to our customers," Apple's statement reads. "Apple's international growth is creating jobs domestically since we oversee most of our operations from California."

Source: TechNet

The company also went on to discuss its taxes, revealing that it pays an "enormous amount" to various governments. In the first half of its fiscal year 2012, Apple says it generated almost $5 billion in federal and state income taxes, including income taxes withheld on employee stock gains.

"We have contributed to many charitable causes but have never sought publicity for doing so," the company added. "Our focus has been on doing the right thing, not getting credit for it. In 2011, we dramatically expanded the number of deserving organizations we support by initiating a matching gift program for our employees."

It concluded its statement with: "Apple has conducted all of its business with the highest of ethical standards, complying with applicable laws and accounting rules. We are incredibly proud of all of Apple’s contributions."

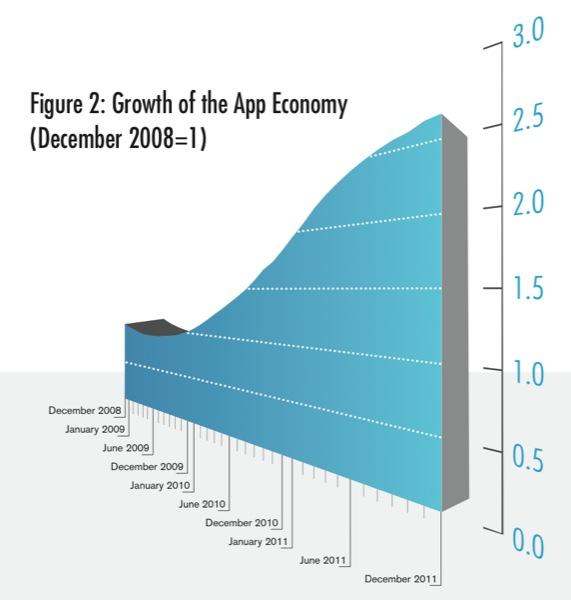

Back in February, an independent report from TechNet issued a report on the number of jobs the iPhone and its App Store have brought to the U.S. since 2008. The report found that the "App Economy" resulted in the creation of nearly 500,000 U.S. jobs in just four years.

AppleInsider Staff

AppleInsider Staff

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Mike Wuerthele

Mike Wuerthele

Christine McKee

Christine McKee

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely