Goldman Sachs ups Apple target to $750, expects 'solid' March quarter

Less than a week before Apple is prepared to announce its earnings for the March quarter, analyst Bill Shope said he expects the report due next Tuesday afternoon to be "solid," with a likely upside. He hasn't been worried by recent volatility with the stock, which saw the company post its largest ever drop of 52 points on Monday.

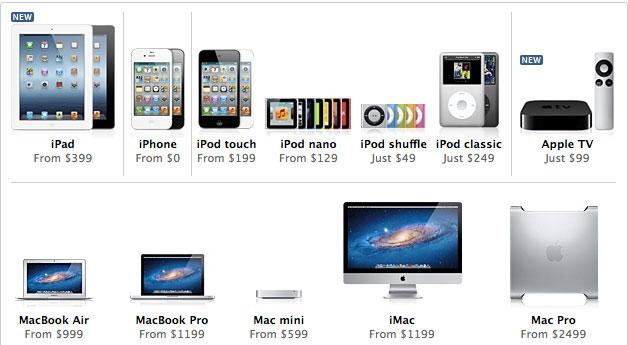

He believes that Apple sold around 31.1 million iPhones in the quarter, along with 12.5 million iPads. Mac sales, he admitted, are likely to be "fairly lackluster," but he still believes his estimate of 4.3 million units and 14 percent annual growth is higher than Wall Street expectations.

While the March quarter is expected to be a positive, the company could be in even better shape for its current quarter, which concludes in June. It will mark the first full three-month span in which the new iPad is available, along with the reduced-price $399 iPad 2, as well as a fully ramped distribution channel with the iPhone 4S.

"In other words, the June quarter is when many of the recent catalysts begin to fully manifest into earnings power," Shope wrote in a note to investors, attempting to dispel concerns that the June quarter could be "catalyst-light."

He also expects Mac sales to rebound quickly over the coming months, as Apple is expected to revamp its product lineup with new laptops and desktops. In particular, Apple is widely believed to be preparing a redesigned lineup of its MacBook Pro notebooks, making them thinner and lighter, and also equipping them with Intel's latest Ivy Bridge processors.

The March quarter will be "the beginning of a very big year," in Shope's eyes, which has led Goldman Sachs to increase its price target for AAPL stock to $750, up from its previous prediction of $700.

Neil Hughes

Neil Hughes

Stephen Silver

Stephen Silver

Charles Martin

Charles Martin

Christine McKee

Christine McKee

Malcolm Owen

Malcolm Owen

Mike Wuerthele

Mike Wuerthele

12 Comments

Goldman Sachs on Wednesday increased its price target for Apple stock to $750, and has advised investors to buy in prior to next week's earnings report.

Pump and dump by ANALysts?

Pump and dump by ANALysts?

Really? It would only be a worthwhile pump and dump if the stock were going to go back down. Well, it will go down again. It won't be a straight line up but you're going to have to get some good timing to play that game with AAPL. The recent target increases are good news for AAPL holders indeed but there's really no evidence that the motivation is for profit on a quick turnaround.

I was following AAPL in the afterhours yesterday and I noticed some real strange, big trades. I'm fairly new to trading, so perhaps this might be totally normal, but this sure seems strange to me.

AAPL was trading around 607 in extended hours when I was watching, and then all of a sudden, these huge volume buys come in at 609.70, a bunch of them in roughly 5 minute increments.

Why would somebody buy in at much more than the market price? The volume was also pretty big on these trades, so those extra dollars paid per share adds up to a significant amount. This was no small time trader buying up 100 shares of AAPL.

And just for fun, I listed some shares of mine to sell at 609.50, after I saw those weird trades and about 5 minutes later one of the big volume 609.70 trades happened again, but my sell order never got triggered. It was as if my sell order was totally ignored. AAPL was still trading around 607 when this happened.

I never had any doubts ...

Finally some logical analysts.