Quarterly dividend expected to expand Apple's shareholder base

Analyst Gene Munster with Piper Jaffray noted on Monday that Apple's quarterly dividend represents an annual yield of about 1.8 percent, which is slightly higher than other big cap tech companies. He believes most on Wall Street were expecting Apple to offer a dividend with an annual yield closer to 1.5 percent.

"While the dividend has been widely expected, we believe that the dividend will make AAPL viable to a broader base of shareholders," Munster wrote in a note to investors on Monday.

In addition to the dividend, which Apple announced on Monday, the company is also initiating a $10 billion share repurchase program, representing about 2 percent of total shares outstanding. Together, the dividend and buyback are expected to cost Apple about $45 billion over the next three years.

Munster estimates that Apple will generate about $70 billion in operating cash flow in its fiscal year 2013, with 40 percent of that coming from the U.S. Excluding the dividend and buyback, he still expects Apple to generate between $11 billion and $13 billion in U.S. cash in the 2013 fiscal year.

"While some investors may have wanted some more visibility into future increases in the dividend, we believe the dividend achieves the main goal of expanding AAPL's share holder base," he said. "Given Apple will still be generating significant net cash, we believe the dividend could increase by 20% after the first year."

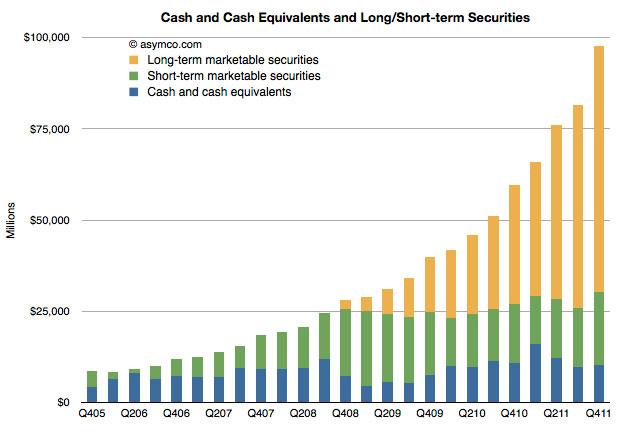

The growth trajectory of Apple's cash hoard, via Asymco.

Apple executives did indicate to analysts in a conference call that the new program will be reviewed "periodically." He said there will not be a set timetable for reviewing the dividend amount or share buyback program.

Munster also said on Monday that he still believes Apple sold more than one million iPads on last Friday's launch day, including pre-orders. He expects a slight upside to Wall Street's expectations of 10.2 million iPad sales in the March quarter.

Apple declined to reveal specific iPad sales figures on Monday, though Apple Chief Executive Tim Cook did say it was a record launch, and that he was "thrilled" with the initial response. AT&T also indicated that Friday was a record day for iPad activations and sales for the carrier.

Neil Hughes

Neil Hughes

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Chip Loder

Chip Loder

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Michael Stroup

Michael Stroup