Evercore raises Apple price target to $750 on new dividend, iPad momentum

Apple's stock hit a new milestone on Monday when it closed past the $600 mark. The surge came after Apple announced earlier in the day that it was initiating a dividend of $2.65 per share and a share repurchase program.

The Cupertino, Calif., company also revealed the good news on Monday that sales of the new iPad during its recent launch weekend topped 3 million. Executives have indicated that they are "thrilled" with the record weekend.

In a note to investors, Cihra called the 1.8 percent yield "modest," while predicting that it will "help broaden" Apple's investor base. He characterized the company's share repurchase program as "long overdue." The analyst viewed the announcements as meaningful because Apple "at least broke the seal."

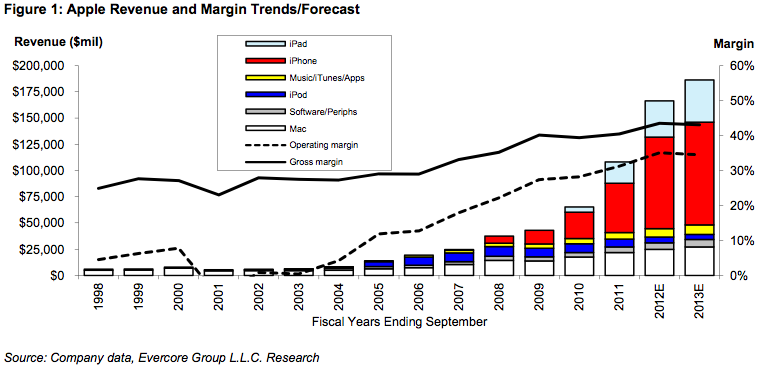

"Even factoring in the new dividend and small buybacks, we model Apple exiting CY13 with net cash approaching $180B or $190/share, leaving room for today’s initial payout metrics to expand," he said.

Cihra, a five-star rated analyst according to Starmine, raised his estimate for first quarter calendar 2012 iPhone sales from 30 million to 32 million units. He also lift his iPad estimate from 10 million to 13 million on "strong initial uptake."

The investment bank advisory firm pointed to an "upside in momentum out of the gates" as the reason for the increase in its iPad estimate. For calendar 2012, Evercore now expects sales of 66 million, up from 59 million.

Cihra added that he continues to "see prospects for a unique mid-cycle iPad refresh" coming around September. The update could bring the introduction of a quad-core A6 processor and a "new smaller 8-inch model," he wrote.

The firm reiterated its Overweight and Top Pick ratings for Apple and raised its price target to $750 from $650.

Josh Ong

Josh Ong

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Chip Loder

Chip Loder

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Michael Stroup

Michael Stroup

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele