Apple's iPhone takes 75% mobile phone profits with just 9% of units sold

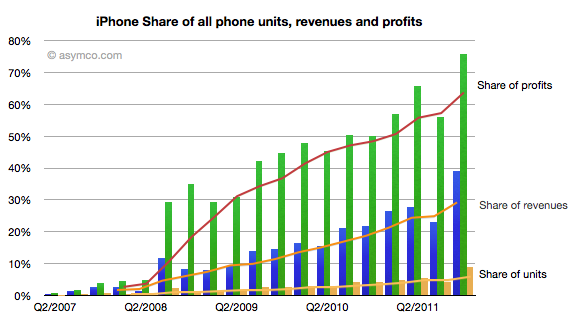

While Apple only sells smartphones, its sales are now large enough to make up 9 percent of all phones sold, highlighting how rapidly the smartphone is taking over the basic phone market.

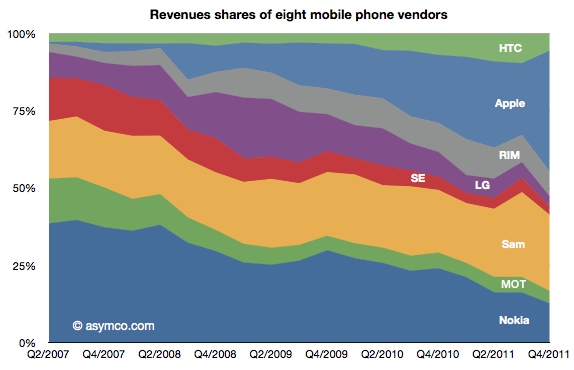

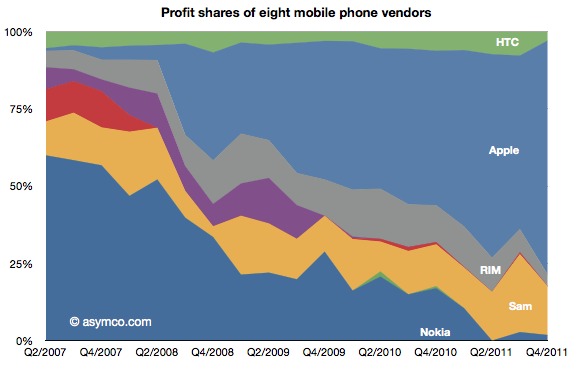

Despite that relatively low share of all unit sales however, Apple takes in the most revenues and earns by far the most profits, as graphically depicted by Asymco writer Horace Dediu, a former Nokia analyst.

Dediu has previously presented how Apple rapidly became the most profitable phone maker by the end of 2008, when the company's iPhone franchise was bare a year and a half old. Apple subsequently took the top spot in mobile revenues last year, although Samsung briefly surpassed Apple in revenues the third calendar quarter.

In terms of profit share however, Apple has led the industry almost from the start, and its share of profits among mobile phone vendors has regularly gone up since.

The only other highly profitable smartphone maker is Samsung, which earned 16 percent of the industry's profits, or as Dediu notes, combined with Apple to earn 91 percent. RIM is third with 3.7 percent profit share, followed by HTC at 3 percent and Nokia at 1.8 percent.

The figures only look at profits for the top phone makers that report their earnings; other phone makers, including ZTE and Huawei, aren't figured into the profit share figures. Given the cutthroat competition in the mobile industry, figures from these and other smaller manufactures would likely reduce Apple's unit share figures but may possibly have little to no impact on its profit share.

LG, Motorola and Sony Ericsson all failed to report any significant profits over the last few quarters, similarly lowering Apple's iPhone unit and revenue shares but having no impact on its profit share.

It follows that Apple could maintain or grow its share of profits while dramatically increasing its unit share as iPhone sales continue to increase, aided significantly by even wider rollouts into new markers and on new carriers. It has been less than a year since Apple added Verizon Wireless as a US carrier, and just a few months since it added Sprint. A large number of carriers still do not carry iPhone.

Daniel Eran Dilger

Daniel Eran Dilger

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Chip Loder

Chip Loder

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Michael Stroup

Michael Stroup

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele