Cheaper iPhone in 2012 could triple Apple's booming sales in China

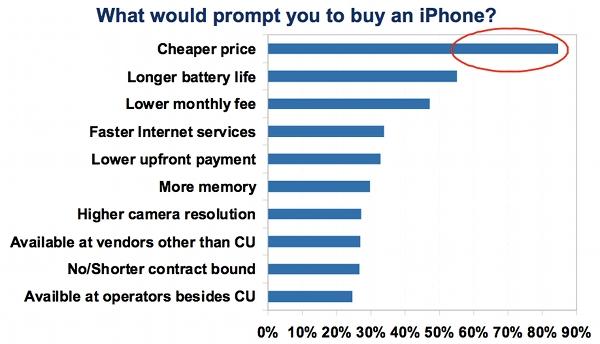

In a research note released on Wednesday, investment bank Morgan Stanley reports that, among Chinese customers who are in the market for a 3G handset but hesitant to buy Apple's iPhone, 85% cite price as the key factor in their decision. Survey responses further suggest that, at the right price point, demand for the iPhone could increase by as much as 2.6x.

Morgan Stanley's AlphaWise market survey indicates that Chinese respondents already looking to buy a 3G phone are willing to pay an average maximum price of 2,716RMB ($425). But, those who said they were unlikely to buy an iPhone noted that 2,200RMB ($344) is the most they could afford. The firm's findings fall roughly in line with a mid-range 'sweet spot' of $350 that industry watchers believe would give Apple greater market penetration.

Apple does appear to have built up substantial brand value among Chinese consumers, as respondents not planning on buying a 3G phone said they would only pay a maximum of 1,631RMB ($253) for a 3G device.

Nearly 80% of respondents marked Apple as the leading smartphone brand in China, toppling the previous leader Nokia. Also, purchase intentions for the iPhone are a whopping 4.5 times its current market share. That's a noteworthy indicator that Apple still has plenty of room for growth in the world's most populous nation.

But, if Apple is to maintain sales momentum in China, it will need to release its new iPhone 4S there soon. According to the firm, the Cupertino, Calif., company's share of mobile phone purchases in the region fell from 12% to 7% last quarter, largely due to customers holding out for Apple's next-generation handset.

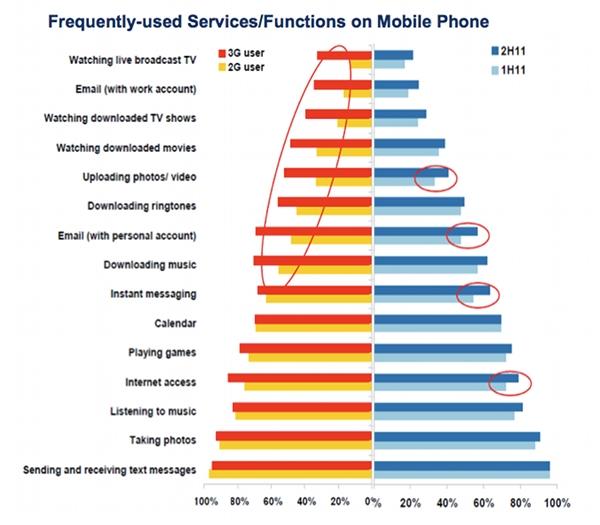

The survey, which draws from online interviews with 2,050 Chinese consumers, went on to show that accelerating 3G adoption is pushing the Chinese market toward phones that feature data-centric functionality, such as streaming videos and fast email access.

China saw an increase in interest for 3G-capable handsets in the second half of 2011, with 90% saying they were likely to buy a 3G phone and 91% opting for a smartphone as their next device, up from 87% and 88%, respectively, from the first half of the year. This upward trend is due in large part to current 2G users wanting to make 3G and smartphone upgrades, causing the firm to suggest that smartphones will move from a niche market into the mass market in China.

Despite the allure of 3G functionality, Chinese users stress that cost is still the deciding factor in purchasing a phone or upgrading their network. In the most recent survey, there was a noted shift in importance from service plan cost to device price after the two were nearly identical in the survey from the first half of 2011. 64% of respondents said they were unlikely to get 3G phones because of device price compared to 53% blaming service plan cost.

After bringing its focus to bear on the region, Apple has seen impressive growth in China. The Greater China area became the company's second largest market, behind only the U.S., in the third quarter of 2011. During a quarterly earnings call last week, executives also indicated that China is "the fastest growing region by far."

The iPhone maker's China sales were $4.5 billion in the September quarter, 16 percent of its total revenue. That's up from $3.8 billion in the June quarter and just $3 billion in all of fiscal 2010.

Apple's retail initiative in China is just taking, as it currently operates just five stores in two cities on the mainland and one in Hong Kong. The company said last year that it plans to open a total of 25 in the country in coming years.

CEO Tim Cook said earlier this year that he believes Apple is just "scratching the surface" of the Chinese market. Meanwhile, one analyst believes that the mobile market in China poses as much as a $70 billion opportunity for Apple.

AppleInsider Staff

AppleInsider Staff

Malcolm Owen

Malcolm Owen

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele

Christine McKee

Christine McKee

William Gallagher

William Gallagher

Marko Zivkovic

Marko Zivkovic