'Unprecedented' demand for Apple's iPhone 5 exceeds iPhone 4 hype

The results of the RBC/ChangeWave survey were released Tuesday by analyst Mike Abramsky. The poll of 2,200 respondents taken between Aug. 2 and 10 found that pre-launch demand for the so-called "iPhone 5" exceeds that of the iPhone 4, as a similar poll conducted in 2010 found 25 percent of respondents would buy Apple's fourth-generation smartphone.

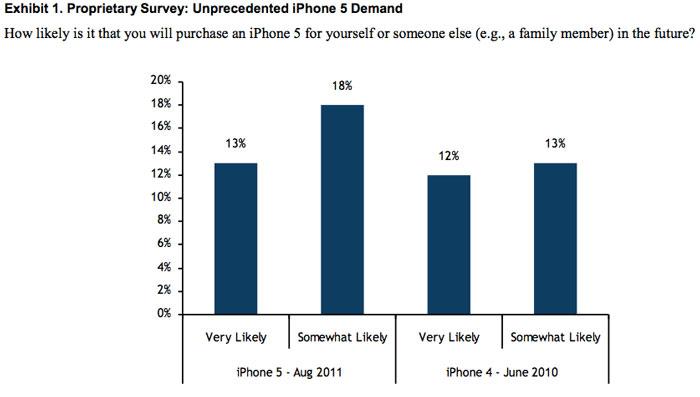

In all, 13 percent of respondents said in August 2011 that they are "very likely" to buy a fifth-generation iPhone, while 18 percent said they are "somewhat likely." That's even better than the 12 percent who were "very likely" and 13 percent "somewhat likely" to purchase an iPhone 4 in June of 2010.

Abramsky also pointed out what he believes will be a "significant" upgrade cycle, as the iPhone 4 is nearly 15 months old. The poll found that 66 percent of existing iPhone users are very or somewhat likely to buy the iPhone 5, which indicates Apple could see a large number of upgraders.

The survey also found strong demand for the next iPhone at carriers Sprint and T-Mobile, where more than 50 percent of subscribers said they are either significantly or somewhat more likely to buy the iPhone if available. Last month, The Wall Street Journal reported that Sprint would offer the iPhone 5 alongside AT&T and Verizon in October.

Because of the survey's indication that iPhone 5 demand is high, Abramsky has raised his estimated fiscal 2012 iPhone sales to 110 million, up from 105 million. He sees Apple selling 27 million iPhones in the first quarter of fiscal 2012 alone.

The survey also asked respondents about the iPad, and the results show utter dominance for Apple, with 85 percent of all tablet buyers planning to buy the iPad. That's up from 82 percent in February.

The survey data also shows strong back-to-school buying for the iPad 2, as 26 percent of respondents said they are very or somewhat likely to buy Apple's second-generation tablet. Accordingly, Abramsky has also increased his iPad sales estimate for the fourth quarter of fiscal 2011 to 12.5 million.

RBC Capital Markets sees Apple earning $110 billion in revenue in fiscal 2011, growing to $140 billion in revenue the following year, and $167 billion by fiscal 2013. It has a $500 price target for AAPL stock.

Neil Hughes

Neil Hughes

Andrew Orr

Andrew Orr

Marko Zivkovic

Marko Zivkovic

Malcolm Owen

Malcolm Owen

Christine McKee

Christine McKee

William Gallagher

William Gallagher

Andrew O'Hara

Andrew O'Hara

Sponsored Content

Sponsored Content