Apple profits to benefit as memory, display pricing improves

Citing sources in Apple's overseas supply chain, analyst Shaw Wu with Sterne Agee reported to investors on Wednesday that overall component trends continue to improve through July. The situation has resulted in more favorable pricing, which he believes will be poised to profit from this change.

Wu said that Apple has, in the past, proven to be among the most adept in the technology industry to take advantage of lower pricing. That strength has been largely credited to Chief Operating Officer Tim Cook.

"This is the opposite of what we saw earlier this year due to the unfortunate events in Japan," Wu wrote, "where component pricing is now more a tailwind as opposed to a headwind."

Previous reports suggested that the devastating earthquake and tsunami that struck Japan earlier this year had shaken up the supply chain for Apple and many other technology companies. The situation allegedly forced Apple to diversify and seek out component makers outside of Japan.

While reports of component constraints persisted after the disaster, Apple publicly said that the incident had not greatly affected the company's supplies. Cook also said that the economic effects of the disaster in Japan paled "in comparison to the human impact."

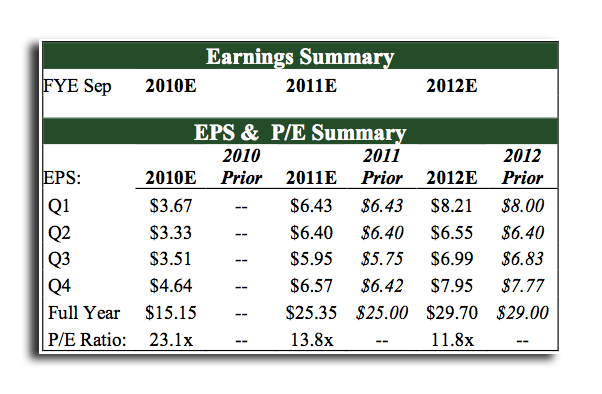

With the anticipated improvement in component pricing, Wu has accordingly raised his forecasted gross margin for Apple to 39.8 percent, up from 39 percent, for the quarter. That has also pushed his predicted gross margin for Apple's fiscal 2011 to 39.5 percent, from 39.2 percent.

On forecasted sales of 6.8 million iPads, 17 million iPhones, 3.9 million Macs and 8.3 million iPods, that would result in an estimated $24.6 billion in revenue and $5.95 earnings per share for the quarter. For fiscal 2011, Wu sees Apple taking $103.7 billion in revenue and $25.35 earnings per share.

Sterne Agee has maintained its buy rating for AAPL stock, with a price target of $460.

Neil Hughes

Neil Hughes

William Gallagher

William Gallagher

Wesley Hilliard

Wesley Hilliard

Andrew Orr

Andrew Orr

Amber Neely

Amber Neely