Apple seen introducing mid-range contract-free $350 iPhone in Sept.

"It's time for a mid-range iPhone," analyst Chris Whitmore with Deutsche Bank declared in a note to investors on Monday. He believes Apple will offer a lower-end iPhone priced between $300 and $500 paired with a pre-paid voice offering.

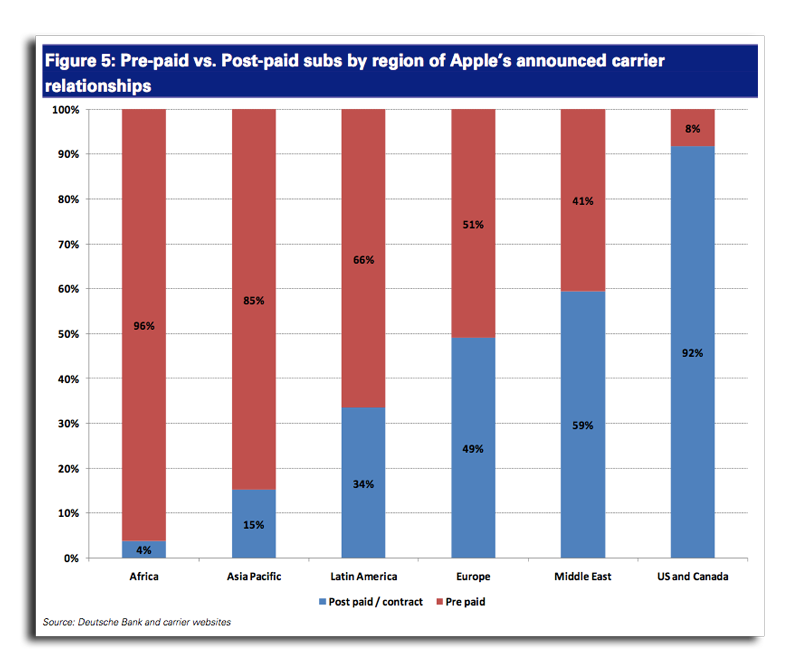

Whitmore noted that of the addressable market of 1.5 billion mobile customers worldwide, two-thirds of those are pre-paid users. He sees a so-called "iPhone 4S," released alongside an anticipated fifth-generation iPhone, as a new category of device that would help Apple address that market.

If Apple were to price this "iPhone 4S" at $349, Whitmore estimates that Apple could have the product be incremental to its corporate gross margin without negatively impacting profitability.

"Apple shipped (about 87 million) units over the past 2 years which suggests it has reached only 6% penetration of its current addressable subscribers," Whitmore wrote. "Looking forward, we believe Apple has room to run both in terms of greater market penetration as well as incremental carrier additions going forward."

Whitmore sees an "iPhone 4S" that would look a lot like the low-end iPod touch. He estimates that an unlocked iPhone priced at $649 has a manufacturing margin of 70 percent, while the $229 low-end iPod touch has 38 percent margins.

"Using this framework, we believe an 8GB iPod touch with an RF module could be priced ~$350 (unlocked without a contract) and still generate healthy manufacturing margins of ~53%," he said.

Speculation of a contract-free entry-level iPhone geared toward the huge global prepaid market is of course nothing new. Just last week, a different analyst stoked the fire by declaring that a "mini iPhone" would give Apple a larger piece of a $70 billion worldwide market.

Wall Street watchers believe that a cheaper iPhone would be a meaningful way for Apple to expand the market of its smartphone business. Surveys based in China, where prepaid subscribers are the majority, show that hardware cost, service plan cost and upfront payment are the three largest hurdles, respectively, to iPhone adoption.

In addition to speculation and encouragement, there have also been media reports that have suggested Apple is working on a cheaper iPhone. In February, The New York Times revealed that Apple has looked into building a cheaper iPhone, but rebutted reports from The Wall Street Journal and Bloomberg that claimed the company is planning to release a smaller model about half the size of the iPhone 4.

Neil Hughes

Neil Hughes

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Chip Loder

Chip Loder

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Michael Stroup

Michael Stroup