Apple to begin assembling iPhone 5 'in mid to late August'

After meetings with unnamed individuals in Taiwan last week where Apple's supply chain and manufacturing facilities reside, Morgan Stanley analyst Katy Huberty issued a note to clients in which she confidently stated:  "Apple’s next iPhone will begin production in mid to late August and ramp aggressively" into the calendar fourth quarter.

She added that, based on her intelligence, the new handset will launch and be available to consumers sometime near the end of the third calendar quarter of the year, which ends September.

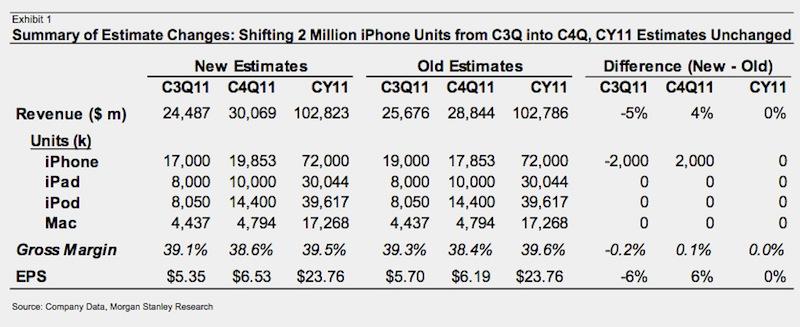

As a result of the later than usual launch, Huberty shifted 2 million iPhone units from the firm's third quarter estimates to its fourth quarter estimates, though the firm's full year estimate of 72 million units remain unchanged. However, the analyst notes that if the next iPhone were to come out in early September, it would "drive upside" to Morgan Stanley's lowered estimates.

Lower priced iPhones and an Apple-branded TV may also be in the works, Huberty noted. According to the analyst, Apple is forecasting a large iPhone unit increase in 2012 "on the back of new products and potentially lower price points." Various major news outlets reported this spring that Apple is planning a cheaper iPhone model, which analysts believe would help the company make gains in emerging and prepaid mobile markets.

"We also believe Apple is in the early design stages for a TV, which could add $19 billion and $4.50 of annual revenue and EPS longer-term," Huberty continued. In March, the analyst reported that checks in Asia suggested Apple was working on a "Smart TV prototype." Earlier this week, an unverified report claimed to leak Apple's plans for iOS-powered connected TVs, citing a "former Apple executive" as the source.

In addition to Apple's ramping up of iPhone production, Morgan Stanley sees upward pressure on iPad shipments as post-Japan earthquake product constraints have subsided. Huberty also echoed reports that improved component supply has led Apple to negotiate price cuts with some of its suppliers. Those cuts could boost margins "modestly in the June quarter and more in September," the note read.

A recent report out of Asia said Apple has demanded 10 percent price cuts from iPad suppliers as orders increase. The report specifically cited companies supplying printed circuit boards, optical components, battery modules and touch panels as being pressured to lower prices.

Huberty sees the recent dip in Apple's share price as a buying opportunity for investors in light of the prospect of improved shipments of the iPhone and iPad. Morgan Stanley reiterated its Overweight rating of Apple, with a price target of $428. The company's stock has slide more than 6 percent to $326.35 since the beginning of June.

Josh Ong

Josh Ong

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Chip Loder

Chip Loder

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Michael Stroup

Michael Stroup

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele