Gartner's iPhone, Android predictions radically revised in a year and a half

This week, Gartner said it believes that Google's Android platform would be used by 49 percent of all smartphones by 2012 and that by 2015, Microsoft's Windows Phone would leap to second place among smartphone platforms (not counting tablets or media players), overtaking Apple's iOS iPhone. The firm supplied very precise numbers for its claims, down to the thousands of units.

Last prediction wasn't very accurate

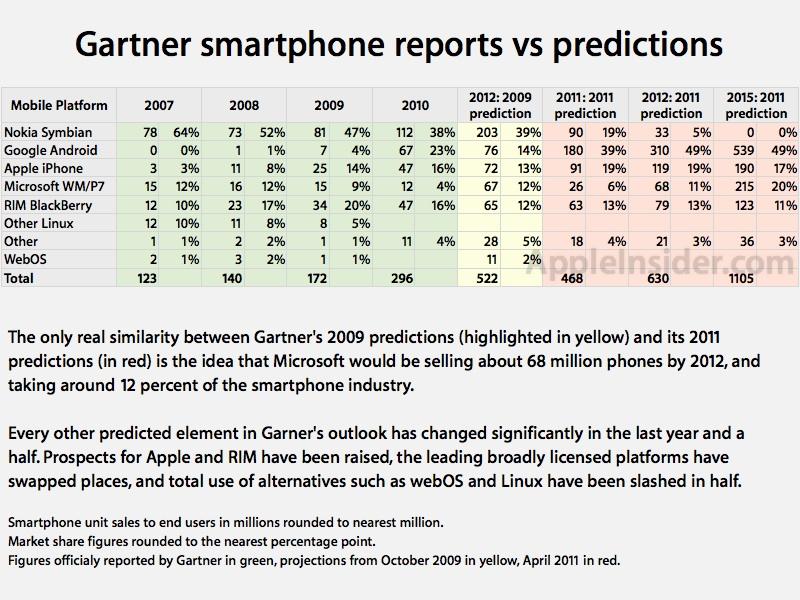

Just a year and a half ago, the same firm made similar bold predictions about the smartphone industry that suggested the same dramatic turn around for Microsoft. In fact, the only real similarity between the company's 2009 predictions and its 2011 predictions is the idea that Microsoft would be selling about 68 million phones by 2012, and taking around 12 percent of the smartphone industry.

Every other predicted element in Garner's outlook has changed significantly in the last year and a half. Nokia's Symbian, once seen as holding on to the lion's share of smartphones in 2012 (with more market share than it managed to retain last year) is now expected to dry up and blow away, given Nokia's plans to drop support for it and focus on WP7 later this year.

Android, originally expected to reach essentially a dead heat with Apple, Microsoft and RIM (all reaching within one percentage point of having 13 percent shares of the market), is now seen as taking half of the market, while Apple's share is now expected to grow much faster than Gartner originally predicted just 18 months ago (grabbing 19 percent as opposed to just 13 by 2012).

Gartner also revised its outlook for RIM, suggesting less of a loss in market share than originally anticipated back in 2009. The firm also slashed its collective outlook for Palm's WebOS and other smartphone operating systems (such as non-Android Linux) in half.

It foresees so little growth among WebOS, other (non-Android) Linux, and other mobile operating systems that it now dumps them all into one category. Note that prior to Android's release, many of Google's licensees (including Motorola) were already broadly using Linux, which Android incorporates.

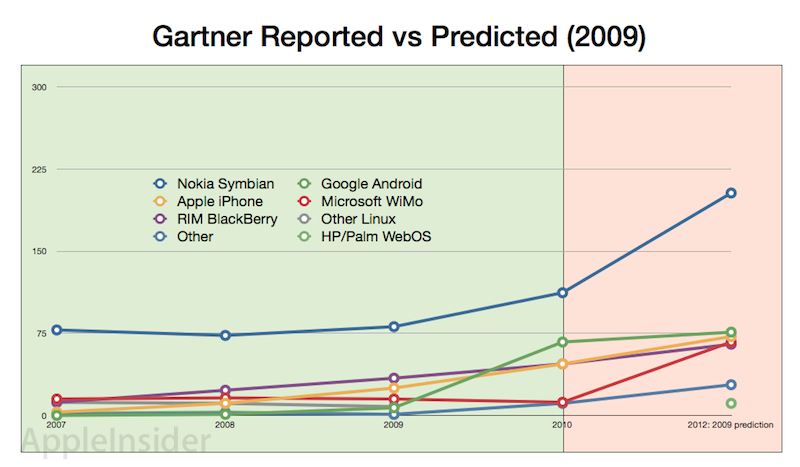

Gartner's vision in 2009: open wins, but mostly Microsoft does

Gartner's most recent prediction is an acknowledgment that it had no real notion of what was going to happen just 18 months ago. Gartner's original prediction in late 2009 essentially just plotted continued, conservative growth paths out for Apple, RIM and Palm, the three major vendors who own their own operating system. It drew tremendous growth in sales for Nokia's platform, likely due to the company releasing Symbian as an open source project, even though Nokia continued to be the primary (and almost exclusive) user of Symbian.

Android was also given a dramatic projection of unit growth of nearly 11x over three years, as it was just beginning to gain traction. In late 2009, Verizon Wireless was gearing up to replace its former dependance upon RIM's BlackBerry platform with new Android-based partnerships with HTC and Motorola under its "Droid" branded campaign.

However, the biggest and most difficult to fathom prediction by Gartner was Microsoft's reversal of fortune for Windows Mobile. That platform had already clearly lost its initial momentum, with sales remaining flat since the iPhone debuted in 2007. Despite those dim prospects, while Gartner suggested in 2009 that RIM's sales would nearly double and Apple's would almost triple, it stated that Microsoft's would grow more than 4.5x in the same three year period.

Rather than that happening, Microsoft's Windows Mobile platform continue to decline through 2010 despite a heavily promoted deal with LG. And when Microsoft released WP7 as its improved new version of the platform and ended compatibility with previous versions of Windows Mobile, sales tanked completely.

Gartner's 2009 predictions were essentially a bet that openly licensed platforms would make tremendous gains in the market while Apple and RIM would only make incremental progress. While Gartner was correct in guessing that Android would make big gains, it also stated that both Microsoft and Nokia would also grow their platforms at a dramatic rate.

Given that Android, Symbian and Windows Mobile all compete to served the same finite group of phone makers, the prediction that all three platforms would each explode and far outpace the growth of the independent Apple and RIM doesn't appear to have a solid logical foundation. In the end, Gartner's 2009 prediction made three bold claims about change in the smartphone industry's trajectory, two of which were completely wrong and one of which wasn't bold enough. It also clearly underestimated Apple and RIM.

Gartner's vision in 2011: open wins, but mostly Microsoft does

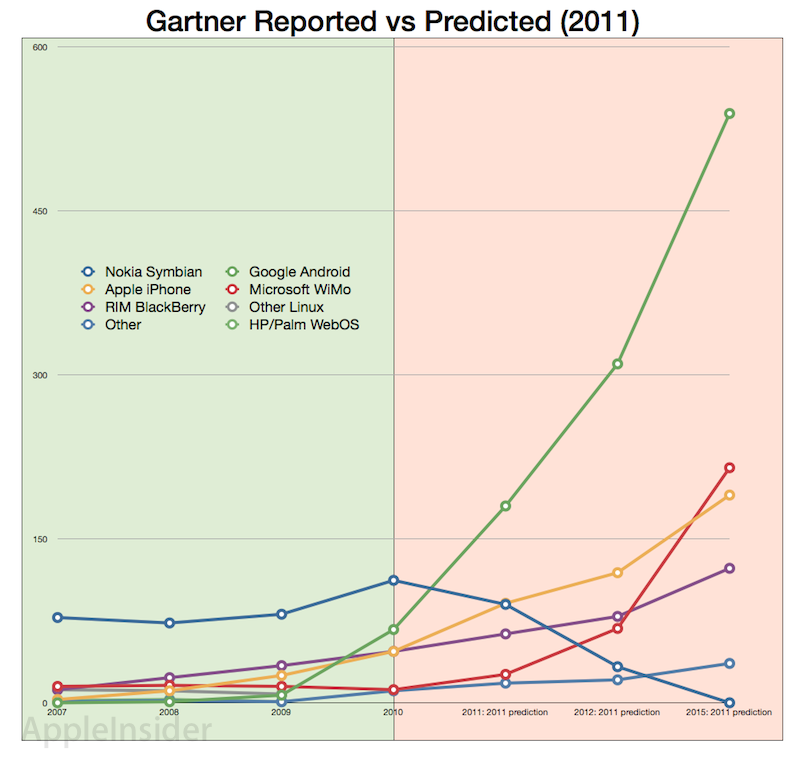

Gartner has now corrected its vision with a new set of predictions that now see Symbian collapsing rapidly, following Nokia's announcement that it would stop promoting its use internally and more recently that it is shutting down its open source project supporting it.

The second major correction in vision sees Android continuing to explode in adoption, growing nearly as fast as it did in 2010, when it was protected from much direct competition with the iPhone in the US, while it was being exclusively backed by Motorola, and while Microsoft and Symbian were both experiencing retooling fiascos.

Gartner also corrected its expectations of the iPhone. It now expects Apple to nearly double its sales this year, leaping from 47 million to 91 million. Next year however, it says Apple will only grow by an additional 28 million units, and then continue to expand by just over 35 million per year through 2015. The means that over the next five years, Gartner thinks the iPhone will grow by just 4x.

Instead of projecting three years into the future, Gartner is now peering a full five years out. That's when it sees Microsoft nudging past the iPhone by 35 million units to become the second place mobile operating system behind Android. Microsoft's resurrection of WP7 is expected to come via help from Nokia, with the fruits of their partnership resulting in a doubling of sales this year alone, despite the fact that Nokia doesn't expect to deliver its first WP7 model until the end of the year at the earliest.

Across five years, Microsoft's unit sales are expected to grow by an astounding 17.9x, more than twice as fast as Android and 4.4x faster than Apple.

Gartner's profitable projections

Gartner's projection of WP7 overtaking the iPhone and outpacing Android growth by 2015 is literally the only good news available for Windows Phone 7, which has completely flopped as a consumer platform despite a half billion dollar ad campaign.

Even Microsoft's leading partner LG called its launch as disappointing and the software itself as being "a bit boring."

If Gartner's historical predictions were more accurate, it would be harder to suggest that the firm was simply concocting its numbers to fit a particular outcome for profit rather than modeling numbers to deliver a useful outlook for the market.

It certainly wouldn't be the first time. Microsoft's confidential memos leaked during its monopoly trial state that the company paid hundreds of thousands of dollars to Gartner as it "lobbied" the firm to change its outlook to flatter Windows NT and denigrate competing Network Computers in the late 90s prior to that trial.

More recently, Gartner analysts began predicting in 2005 that Windows Mobile 5 would cause big trouble for Symbian, something that never happened. In 2009, the outlook for Windows Mobile was so bleak that even Gartner refused to say it would surpass the iPhone in three years. The situation for Microsoft has only grown worse over the last year and a half, with the company's Nokia deal seeing little positive comment in the tech media.

Gartner's latest prediction now claims Microsoft's WP7 will grow by more than 1,790 percent over the next five years, significantly faster than Android or the iPhone over the same time period, faster than Android grew last year, and faster even than Gartner incorrectly predicted Windows Mobile would grow back in 2009.

Daniel Eran Dilger

Daniel Eran Dilger

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Chip Loder

Chip Loder

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Michael Stroup

Michael Stroup

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele