Nokia's rejection of Android may help resolve patent war with Apple

A report by Florian Mueller of FOSS Patents notes Nokia's patents are one of the company's strongest assets; resolving its complaint with Apple quickly may give it a better opportunity extinguish its "burning platform" and get back to business.

"In his presentation to investors, Nokia CEO Stephen Elop said that they have 'one of the strongest patent portfolios out there,'" Mueller wrote, "and they are willing to license it to others 'at an appropriate royalty rate.' This translates as stepping up their outbound licensing efforts."

Nokia and Apple are currently embroiled in a series of patent disputes, with Nokia accusing Apple of refusing to pay royalties for its use of technology standards that involve Nokia's intellectual property (including WiFi, GSM and 3G).

Apple counters that Nokia is demanding an unfair premium for patents which the company has previously promised to offer under fair, reasonable and nondiscriminatory (F/RAND) terms, and adds that Nokia is infringing upon its iPhone-specific patents, which were never pledged to be offered under F/RAND terms as part of an open standard.

One reason why Nokia rejected Android: patents

In contrast, Google has a weak footing in patents, with a much smaller patent portfolio than other players in the smartphone business. That will prevent Google from being able to resolve patent disputes through cross licensing, because it doesn't have much to offer in trade.

Google's Android is a lawsuit magnet, with already a dozen disputes noted by Mueller. This includes Apple's suits against Motorola and HTC, Microsoft's suit against Motorola, Oracle vs Google, a variety of other companies suing Google and its licensees, and even licensees suing each other, such as the case between Sony and LG.

In addition to being in a weak position itself, Google is not stepping in to support is Android licensees as they come under attack. Instead, it's piling on more controversy by pushing WebM, another technology with a patent target painted on its back but no indemnity protection offered by Google.

What Microsoft offers Nokia with Windows Phone 7

"The partnership between Nokia and Microsoft should make it much easier for Apple and Nokia to work things out between them and strike a cross-license deal," Mueller wrote, adding that Apple would be unlikely to file suit against Microsoft, given that the two are also partners (in the area of Exchange Server particularly) and have already resolved their differences in a series of cross licensing agreements.

Further, the patents Apple is now asserting against Nokia largely relate to touchscreen interfaces. A partnership with Microsoft's Windows Phone 7 could allow Nokia to move forward without infringing upon Apple's patents, or could involve a new cross-licensing agreement where Microsoft served as a moderating factor.

Thirdly, Mueller notes that "in light of market dynamics, it would now make a whole lot of sense for Apple and Nokia to stop wasting resources on their fight with each other and instead focus on license deals with all those makers of Android-based devices."

Apple likely to view WP7 as a minor threat

Apple's patent dispute with Nokia has dragged on because the iPhone maker does not want to hand its proprietary iPhone inventions to the world's mobile maker simply to gain unfairly priced access to royalties related to network standards that it believes should be available at F/RAND terms without such concessions. The most idea resolution for both companies would be for Nokia to adopt Windows Phone 7 for its high end smartphone business.

Apple likely sees little threat from WP7, given Microsoft's failed launch last fall, with nearly nonexistent demand from consumers and even a feeble showing from developers.

Android, on the other hand, exerts a plausible threat to Apple because even though Google has far less experience in managing a development platform than Microsoft, the software can be picked up for free for use by cloners to flood the market with knockoff goods.

One rapidly growing Android licensee, the Chinese maker Huawei, is being sued for refusing to pay standard licensing fees managed by Helferich Patent Licensing, a group that represents the patent interests of Apple, Microsoft, HTC and more than twenty other companies. Apple (and other companies) would clearly prefer to deal with companies that play by the rules rather than chasing foreign Android licensees through the courts, particularly ones doing business in countries that don't respect intellectual property rights.

Once Nokia and Microsoft begin to collaborate on new WP7 phones, the supply of such devices will be relatively small, because Nokia's current smartphone business is largely made up of handsets incapable of running a full screen system on the order of WP7 or Apple's iOS. Most of Nokia's "smartphones" would be easily confused with other makers' feature phones, sporting small screens and simple, button-oriented interfaces.

Nokia converting its relatively meager high end phones to WP7 is a far better situation for Apple than were the world's largest phone maker to embrace Android and begin converting its large piece of the overall smartphone market into Android market share.

Nokia's WP7 deal creates an Android competitor for Apple

An amicable patent cross licensing agreement between Nokia and Apple would allow Apple to continue expanding its iOS business and allow Nokia to move forward with plans to stabilize its huge, broad market for simple Symbian models on one hand (to be managed under the newly created Mobile Phones unit) while it also experiments with MeeGo and Symbian and works to transition toward new WP7 models on the other (within a separate unit to be named Smart Devices).

So, rather than simply pushing Nokia's roughly 38 percent share of the smartphone market into Microsoft's column, as some have imagined, Nokia will continue to build a broad range of cheap "smartphones" based on Symbian for sale in emerging markets, and divert only its poor showing on the high end to Microsoft's new platform. Nokia's high end smartphone business was passed by Apple a long time ago.

At the same time, Nokia will breathe some credibility into Microsoft's WP7 platform, giving carriers and their customers more choices among the next generation of modern smartphones: WP7, HP's webOS, RIM BlackBerry, Android, and Apple's iOS.

The problem for Nokia is that it is partnering with what is the biggest failure in smartphones; WP7 has nosedived at launch, despite upbeat-sounding reviews and the marketing strength Microsoft pushed behind it. LG, its biggest licensee, described the platform as 'a bit boring' and suggested it might find a following among low end users with simple needs. That's not really what Nokia wants to do with its high end smartphones.

The problem for Microsoft is that it is partnering with the failed end of Nokia. While the largest phone maker globally, Nokia's efforts to launch a modern smartphone have been scattered and incomplete. It describes is N900 pocket computer smartphone as an experiment, while its flagship iPhone competitors have failed to see the same demand as Apple, particularly in the US where Nokia recently canceled its X7 launch.

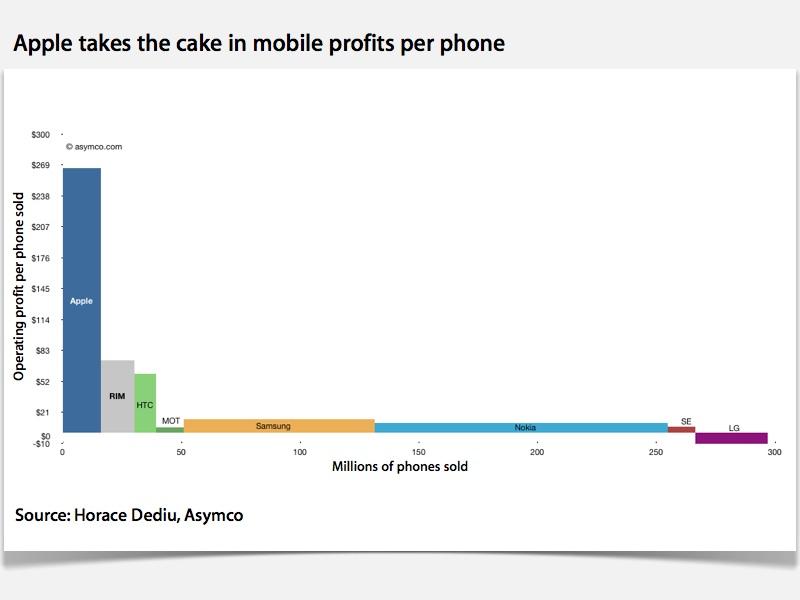

Nokia's existing smartphone business is broad but short in profits per phone, as depicted in a report by Asymco.

Daniel Eran Dilger

Daniel Eran Dilger

Mike Wuerthele

Mike Wuerthele

Christine McKee

Christine McKee

William Gallagher

William Gallagher

Andrew Orr

Andrew Orr

Sponsored Content

Sponsored Content

Malcolm Owen

Malcolm Owen