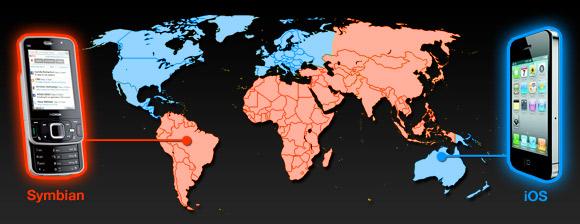

Global mobile split between Apple's iOS and Symbian

StatCounter's headlines

An initial report on StatCounter's data suggested an American comeback by RIM's BlackBerry, shored up by data that showed RIM grabbing the lead in the US with 34.3 percent of all web traffic from smartphone users, just two years after Apple trounced RIM with three times its presence in US web stats.

Mike Abramsky of RBC Capital Markets explained in a note that RIM's sudden assent in browser stats was "likely on uptake of the release of new BlackBerry [OS] 6 devices (with their improved [Web Kit] browser." He added, "alternatively, it may also reflect how Apple and Android users are doing more apps than browsing on their devices."

Reports of data culled from web analytics firms like StatCounter only take into account web traffic, and aren't able to monitor how phones are being used. They can also offer misleading slices of accurate data that are nearly meaningless to the market because they overrate the importance of a headline-grabbing detail while ignoring surrounding facts of greater significance.

iOS with the iPod touch

Pingdom, a vendor of network server monitoring tools, has supplied its own take on StatCounter's figures with a global look at mobile OS usage. While the first StatCounter report presented data only on smartphones, Pingdom included stats for the iPod touch (but not the iPad) in its iOS figures.

Apple's market position with iPhone is supported by iPod touch sales; long before the company could line up distribution deals for the iPhone with carriers globally, the iPod touch was bundled with other phones by those carriers, introducing their users to the iOS and likely tilting their next phone purchase in favor of the iPhone.

Other mobile device makers also offer iPod touch-like devices, but none have become very popular. Smartphone stats that ignore the iPod touch don't provide a realistic view of the mobile market, and in particular the demand for software specific to a given mobile platform.

For example, while sales of all phones from all manufacturers using some version of Android have overtaken the iPhone in the US, they haven't eclipsed the unified market for all iOS devices, which helps to explain (in part) why Android Market isn't leading in mobile software sales, or attracting the same interest from developers and marketers.

Think globally

Additionally, the US is only one part of the global market for mobile devices. Apple has rapidly rolled out both device sales and its App Store to more countries than Android Market, BlackBerry App World, and Microsoft's previous Windows Marketplace for Mobile or its fledgling Windows Phone 7 app store.

This has enabled Apple to take the market share lead in mobile devices away from Symbian in a variety of key markets. Pingdom's stats show the iOS has taken the lead across North America, Australia, and even Symbian's home turf of Europe.

Symbian still leads in Asia, Africa and South America, and not just because cheaper feature phones are selling in massive volume to third world countries. The figures are based on web share, so the mobile devices portrayed in the numbers must at least have a web browser. Entry level Symbian devices do sell for considerably less than full fledged smartphones however.

Beyond Nokia's first place position, Apple is in second place globally, with RIM's BlackBerry in third and Android in fourth place. The report notes that "BlackBerry’s strongest region is North America, but it is still behind iOS there. Android might be growing fast, but it’s still far from dominating any part of the world."

In global numbers, HP's Palm webOS "hardly made a dent," while the report stated that "WinCE is pretty much universally dead. Windows Mobile reaches a couple of percent in a few countries, but that’s about it. We’ll see what happens with Microsoft’s Windows Phone 7."

By nation

Symbian's global lead comes without much presence in the US at all; only 1.36 percent of web traffic in the US comes from Symbian phones. However, Symbian is the leading mobile OS for 100 other countries, and accounts for half or more of the mobile web traffic in 75 of them. Symbian's top ten nations where it is the most popular are Chad, Libya, Sudan, Iraq, Oman, Jordan, Egypt, Somalia, Mozambique and Paraguay; Symbian phones account for 84 to 94 percent of all mobile web traffic in these countries.

Apple's iOS leads in 30 countries, and in 21 of these it accounts for half or more of the country's mobile web traffic. Its top ten countries are Canada, Cuba, Switzerland, Australia, Ireland, New Zealand, France, Singapore, Denmark and Sweden; iOS devices account for between 62 and 84 percent of all mobile traffic in these countries. Japan and Belgium are nearly tied with Sweden, with iOS taking a 61 percent share of all web traffic in those two nations.

In the US, Apple accounts for just over 35 of all mobile web traffic with the iOS, as it competes directly with RIM's BlackBerry and Android. RIM's share of web traffic is 32 percent, lower than the iOS because these numbers include iPod touch.

BlackBerry commands a slight lead when it is only compared against the iPhone, as noted above. RIM doesn't sell an iPod touch-like product, but is planning to enter the non-phone tablet market to compete against the iPad (these stats do not include iPad use however).

BlackBerry is the leading mobile OS in four countries (all in Central and South America), and is tied with iOS in a fifth (the UK). The only nation where BlackBerry enjoys more than half of all web traffic is the Dominican Republic.

Pingdom points out that "interesting enough, considering RIM is a Canadian company, it isn’t all that strong in its native Canada, where it accounts for a mere 3.6% of the country’s mobile web traffic." It also notes that RIM has a stronger presence in the UK than in the US.

Android has a 23 percent share of US traffic, and only leads in one country: South Korea. That's where Samsung has been selling its Galaxy S. There are no other countries where Android makes up more than half of the nation's web traffic.

Daniel Eran Dilger

Daniel Eran Dilger

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Chip Loder

Chip Loder

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Michael Stroup

Michael Stroup

10 Comments

As expected, the other statistical data was mostly tunnel visioning FUD.

Fascinating division of mankind. I wonder what would be the average person's response if one saw that map with no title and had to guess what the map showed?

If you paid a polling and statistics company enough, they could prove that the Microsoft Kin actually has outsold both RIM and Apple combined, and has a greater share of web browsing than both. They can actually prove it.

http://forums.appleinsider.com/showt...41#post1761641

...Statcounter DOES include the iPod touch in its data. Having said that, it's clear that webhits are not telling the whole story of mobile internet usage.