App Store, iAds projected to become 8% of Apple stock value

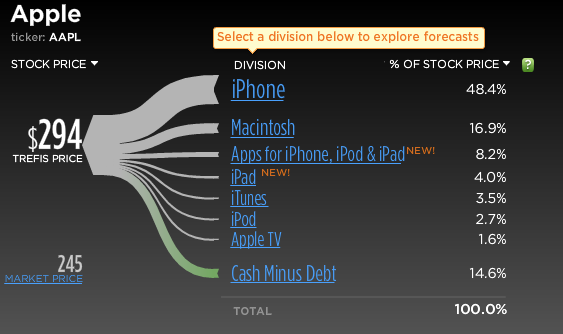

Trefis, an analysis tool that allows investors to estimate how much an assumption could influence a company's stock price, has a price target of $294 for AAPL stock, and it estimates that 8 percent of that projected value represents paid and ad-supported software on its App Store. For comparison, the company has projected that the iPad will constitute just 4 percent of the stock price.

The assumption is based on projected sales of 70 million devices based on the iPhone OS, with 100 million iPhones, iPads and iPod touches in use from consumers. The total number of devices in use is projected to reach 340 million through 2016.

The analysis projected that Apple would see 300 ad impressions per device, per month in 2010. With Apple taking 40 percent of iAd revenue in free applications, and 30 percent of software sales from the App Store, Trefis believes that Apple's gross margin from software on the iPhone OS will grow 38 percent in 2010.

"Since we expect Apple's revenues earned through the iAd platform to be much more than through paid apps, the increase in average app gross margins is significant," the report said.

Previous estimates have suggested total annual revenue from the App Store is as high as $2.4 billion. But Apple's executives have previously revealed that the App Store is not particularly profitable for the iPhone maker. Instead, services like the App Store and iTunes are focused on adding to the user experience by providing easy access to new content.

The Trefis model suggests iTunes accounts for 3.5 percent of Apple's stock price, while the shrinking iPod market equates to just 2.7 percent. The lion's share of AAPL's projected $294 value would come from the iPhone, which is estimated to represent 48.4 percent of the total stock price.

Introduced earlier this month, the iAd program will allow developers to integrate dynamic, interactive advertisements in their free App Store software, and to keep a 60 percent cut of all revenue from that advertising. Apple is betting that the future of advertising in the mobile space does not lie in search, as it has on the desktop, but will instead be found in downloadable software for devices like the iPhone.

Opinions over how much the iAd mobile advertising platform could earn Apple vary wildly. Analyst Brian Marshall with Broadpoint AmTech has said Apple's new business venture could generate as much as $4.7 billion in revenue per year. Conversely, analyst Gene Munster of Piper Jaffray sees Apple's advertising business amounting to $220 million in 2011. Munster noted that the total market for in-application mobile advertising was just $45 million in 2009.

Katie Marsal

Katie Marsal

Malcolm Owen

Malcolm Owen

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele

Christine McKee

Christine McKee

William Gallagher

William Gallagher

Marko Zivkovic

Marko Zivkovic