Apple stock decline called 'normal,' rebound expected by year end

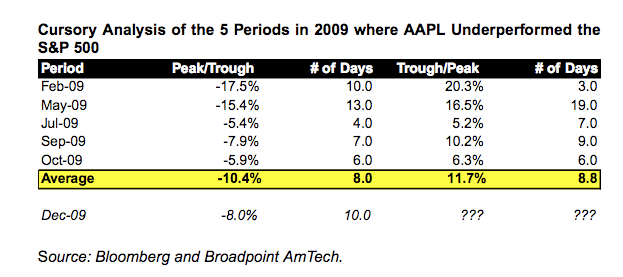

Investors in recent days have become anxious as AAPL stock has given back some of its gains. Analyst Brian Marshall with Broadpoint AmTech issued a new note to investors Wednesday morning to state that Apple's decline is "normal" for Apple.

"Over the past 10 trading days, we have fielded numerous questions from the investment community regarding AAPL's ~8% underperformance relative to the S&P 500," Marshall said. "In our view, the move is 100% related to technicals and position sizing at the year-end... not indicative of fundamental trends."

The note forecasts that Apple's stock price will be over $200 once again by the end of 2009. Historically speaking, when Apple stock does rebound, it takes about as long as it did to drop. In other words, Marshall said, the rebound is typically a "mirror image" of the pull-back.

It's a similar sentiment to the one shared Tuesday by analyst Gene Munster of Piper Jaffray. Munster noted that Apple's stock price typically drops early in the year, and this year he believes the selloff is happening a little early.

Marshall still believes that it will be an "Apple Christmas," ushered in by demand for the iPhone, iPod touch, and a strong Mac lineup. He has forecast revenue of $12.5 billion for the December frame, with $2.27 earnings per share. Those numbers are about $650 million higher than Wall Street's averages.

The note forecasts a record quarter for Apple, with sales of 11.3 million iPhones, 3.3 million Macs, and 19.8 million iPods. With Apple adding more carriers overseas, Marshall expects to see significant international iPhone growth.

Compare those numbers with last quarter — Apple's best ever — when the company sold 3 million Macs, 7.4 million iPhones, and 10.2 million iPods. It earned profits during the frame of $1.67 billion.

"In our view, Apple remains the best technology company on the planet," Marshall said.

Broadpoint AmTech has reiterated its "buy" rating for AAPL stock, and has maintained a price target of $235.

Katie Marsal

Katie Marsal

Malcolm Owen

Malcolm Owen

Christine McKee

Christine McKee

Amber Neely

Amber Neely

William Gallagher

William Gallagher