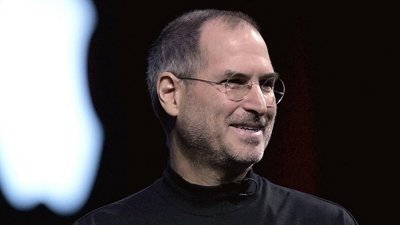

Conflicting reports on China Unicom 3-year iPhone deal

Shanghai Securities News cited unnamed sources in announcing the alleged deal. But after the news broke, Dow Jones Newswires reported that China Unicom spokesperson Sophia Tso has officially said her company and Apple are still in discussions and have not reached an agreement.

The deal reportedly set a minimum threshold of CNY 5 billion ($731 million) in iPhone sales, guaranteeing orders of one to two million devices per year. The source said China Unicom could begin selling the iPhone as early as late September.

Other possible details, as relayed by Fortune Brainstorm Tech: China Unicom will pay Apple 3,000 CNY ($439) per unit and price it below that for customers, Unicom promises to sell a minimum 1 million units per year, and the Chinese iPhone will access "Apple's China App Store."

In February, China Unicom was fingered as Apple's most likely partner by British consulting firm Ovum, followed by a leak of iPhone information inadvertently posted by China Unicom's website and an admission by the company that it was in talks with Apple in March. Earlier this month, Analyst Shaw Wu of Kaufman Bros. similarly claimed that China Unicom would be the frontrunner in marketing Apple's phone in the country.

With over 135 million subscribers as of February 2009, China Unicom is 170% larger in terms of users than AT&T in the US, but it is still China's second largest mobile carrier after the state-owned giant China Mobile, which boasts 471 million subscribers, making it the world's largest carrier by number of subscribers.

The vast size of the Chinese market has kept observers intently interested in how and when Apple would officially enter the market with the iPhone. At its recent earnings call, Apple executives only said they planned to begin selling the iPhone within the next year and described the negotiations as a "priority project." That may have been cover to keep its negotiations productive as Apple pitted the Chinese carriers against each other to gain the best deal.

China Unicom was considered the initial favorite because the company runs a standard GSM/UMTS 3G mobile network using the same signaling technology at AT&T in the US and most other carriers worldwide. In contrast, China Mobile primarily operates a TD-SCDMA network based on Chinese technology developed to avoid paying royalties to Western nations.

In order to deliver the iPhone to China Mobile's subscribers, Apple would have to develop new hardware and software to support the unique system, the same problem facing Verizon Wireless and Sprint in the US, both of which use Qualcomm's CDMA/EVDO; existing iPhone models are already compatible with China Unicom's network. Wu estimated that 1-1.5 million grey market iPhones have already made their way into China.

In addition to phone network compatibility, China Unicom may be more open to allowing Apple to run its own software store and retain control over iPhone features such as WiFi and Bluetooth. In contrast, China Mobile has expressed an unwavering demand to exclusively operate its own mobile software store, a stance also adopted by Verizon in the US.

Prince McLean

Prince McLean

Wesley Hilliard

Wesley Hilliard

Andrew Orr

Andrew Orr

Amber Neely

Amber Neely

William Gallagher

William Gallagher