Firm urges investors to buy Apple after panic on Mac sales

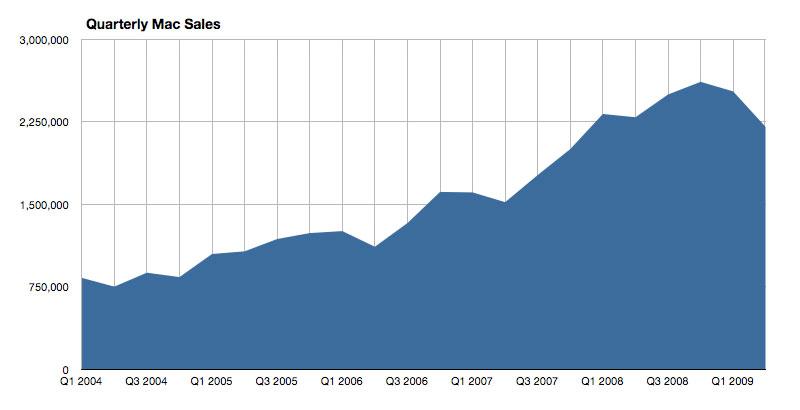

NPD data for January was actually released on Tuesday, but wasn't widely reported until Thursday. The firm's numbers, based on US retail store surveys, indicated a 6% drop in quarterly Mac sales year over year and a 14% drop in iPod sales. The reason for the two day delay in the panic on Apple's stock price relates to several dramatically framed reports filed on Thursday.

The stories all reported Apple's drop in growth in comparison with the company's performance in 2007, as opposed to highlighting Apple's actual performance relative to other companies in the same economic climate. Additionally, many of the articles focused on percentages of growth rather than actual sales numbers or revenue, contrasting proportional changes in growth while ignoring that Apple's unit sales are actually higher now than they were in 2007 when the company was achieving huge percentages of growth.

Analysts Charlie Wolf and Jim Lewellis of Needham & Company filed the brief that called the selloff an "overreaction," noting that NPD's figures only reflect a single month of sales, only look at retail sales, and only reflect US sales; international sales make up 45% of Apple's worldwide figures.

Additionally, the brief noted that Apple actually guided for a 12% decline in sales revenues for the first calendar quarter of 2009 (the company's fiscal second quarter). This is because Apple's guidance of $7.6 to $8 billion in revenue (compared to $7.5 billion in the year ago quarter) also includes $1.5 billion of iPhone revenue deferred on a subscription basis.

In other words, while Apple expects to report greater revenues this quarter over the year ago quarter, it has also figured in money it has already earned but has not yet recognized, due to Sarbanes-Oxley Act accounting rules. Because Apple's guidance accounted for a 12% decline in earnings apart from the subscription accounting revenues already in the bank, the 6% drop in Mac sales is "at worst a non-event" Needham stated in the brief.

Needham estimates Apple will actually report $7.9 billion for the quarter, a 5% increase over the year ago quarter's revenues, and ranks the company a "strong buy."

Mind the GAAP

Many investors have failed to recognize the billions in revenues Apple has earned and collected on iPhone sales, but will only officially recognize in its earnings statements in one-eighth increments each quarter over the two year term of the phones' subscription accounting. To put things into perspective, Apple began releasing "non-GAAP" figures in addition its standard GAAP accounting to make these 'earned but not yet recognized' revenues more transparent.

Even though many observers expect the economy to continue to slump throughout 2009, Apple will continue to report its billions in deferred revenue from iPhones already sold, including the blockbuster fiscal Q3 launch of the iPhone 3G.

After two full years of iPhone sales, the company's GAAP and non-GAAP numbers will begin to approach each other. Until then, Apple is sitting on a huge recession-insurance policy, which is paying out regular dividends that will blunt the retail pain the company is now suffering through. That will continue to keep Apple's results buoyed above the tanking sales of most other retailers and PC makers.

Prince McLean

Prince McLean

Malcolm Owen

Malcolm Owen

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele

Christine McKee

Christine McKee

William Gallagher

William Gallagher

Marko Zivkovic

Marko Zivkovic