Warner picks Amazon, not Apple for DRM-free debut; more

Warner Music Group dealt Apple Inc. a symbolic blow on Thursday by announcing it would sell its first unprotected music through Amazon MP3 instead of iTunes. However, one financial group is more positive and expects Apple stock at $600 in 18 months.

In a potentially significant move, Warner Music Group today said it has licensed its catalog to Amazon for use with its Amazon MP3 music store.

The deal is not fully explained by the music label but will include "album bundles" with tracks unavailable anywhere else, according to the two companies. Like all Amazon MP3 tracks, the songs go without digital rights management and can be copied an unlimited number of times and played back on nearly any device, including iPods.

Securing the Warner deal represents the latest in a series of victories for Amazon against Apple. Although launching only in September of this year, Amazon's store has already licensed MP3 music from Universal and forced Apple to lower iTunes Plus pricing to remain competitive. The iPod maker, in turn, has seen both Warner and Universal potentially opt out of long-term contracts for iTunes on a permanent basis. With today's announcement, both have also excluded Apple from their unprotected music offerings.

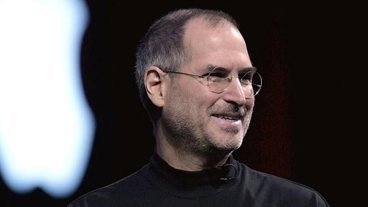

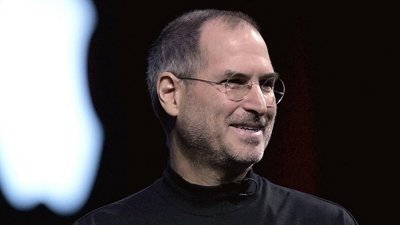

The agreement to offer MP3s also represents a dramatic shift in policy for Warner. The label's chief Edgar Bronfman began the year by lashing out at Steve Jobs for even suggesting that labels should drop copy protection, accusing the Apple executive of abandoning logic. Since then, three of the four major labels — EMI, Universal, and Bronfman's own imprint — have all offered unprotected songs to varying degrees. Only Sony BMG has so far maintained a requirement for copy protection on all its direct downloads.

Report: iPhone to boost Apple stock to $600

While Apple shares have only just flirted with the $200 mark this week, the company is poised to as much as triple that amount in 18 months, says Daedalus Capital chief investment officer Stephen Coleman in an update on his company's outlook.

The financial expert bases this largely on predicted success for the iPhone, which he believes will not only benefit Apple through sales of the phone itself but through revenue-sharing deals. In a more aggressive estimate than some analysts, Coleman estimates as much as 30 percent of subscription revenues for carriers are sent directly to the Cupertino firm.

"There's so much growth to look forward to," he says.

Mossberg credits Dell all-in-one as true iMac rival

Dell's new XPS One desktop is the only Windows PC that can 'match or exceed' the iMac in some areas, according to a new review by the Wall Street Journal's Walt Mossberg.

The technology columnist justifies the response by noting that the Dell all-in-one maintains a clever industrial design while incorporating features absent from the iMac, such as a memory card reader, a TV tuner, and side-mounted USB ports.

The iMac still wins through software, Mossberg adds: Mac OS X is both faster and more valuable than Vista, and is not burdened by trial versions or ad-based software, nicknamed "craplets" by the journalist. And in a reversal of stereotypes, Apple's systems are also less expensive while offering better overall performance and more screen options. Nonetheless, the system may prove viable for Windows users, he writes.

"If you want a stylish Windows Vista machine that runs well and won’t cost a fortune, the XPS One fits the bill, despite its unlikely heritage," Mossberg says.

Katie Marsal

Katie Marsal

William Gallagher

William Gallagher

Wesley Hilliard

Wesley Hilliard

Andrew Orr

Andrew Orr

Amber Neely

Amber Neely